Under a certain market environment, precious metals are considered must-haves in a modern investment portfolio.

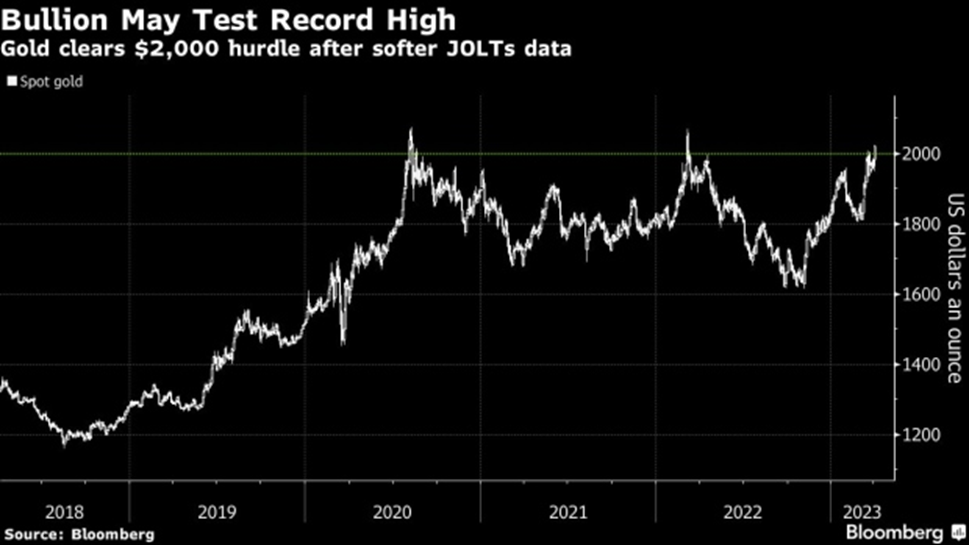

What has transpired so far in 2023 has confirmed that the conditions have been set for gold and silver to soar. Their prices have both seen impressive jumps this year, with gold recently coming within cents of an all-time high, and silver also flirting with price levels last seen a decade ago.

But the precious metals rally, according to some, has only just begun. Analysts believe it’s only a matter of time before both metals set new records.

“I think it’s very plausible that we see a strong performance in gold over the coming months. The stars appear to be aligning for gold which could see it break new highs before long,” a senior market analyst at foreign exchange company Oanda said recently.

Silver is also following a similar pathway to new highs. “We expect to see record prices on an average annual basis at some point in 2024-2026,” Jeff Christian, managing partner of commodities consulting company CPM Group, said in a recent video.

These bullish outlooks are not without substance, given a wide range of market influences that are steering investors towards gold and silver. Below we examine each one of them:

1. Recession Fears

Historically, gold thrives when global economic conditions get worse.

The latest report from the World Economic Forum shows while the global economic outlook has improved since the start of the year, recession fears are still prevalent among divergent views. Nearly half of the participants in the WEF’s latest survey said that a recession is likely, which is a real cause for concern.

“Headline rates have begun to ease, but core inflation is stickier than anticipated and shows signs of picking up. The pressure on many households remains acute, and more than three-quarters of respondents expect the cost of living to stay at crisis levels in numerous countries throughout 2023,” the analysts said.

In the US, inflation is still rampant, and with the Federal Reserve looking to pause its rate hikes, that raises the odds of an economic recession. Then, there’s the political standoff on the US debt ceiling and fears of a default, which many believe could accelerate the recession.

Investors are likely to favor gold as those bets are expected to provide a buffer against the possibility of a US recession this year, according to strategists at JPMorgan Chase.

“The US banking crisis has increased the demand for gold as a proxy for lower real rates as well as a hedge against a ‘catastrophic scenario,’” JPMorgan analysts wrote in a Bloomberg note, adding that “the long duration theme seems to have become a consensus in recent months.”

Such a trade looks “relatively attractive” as it would have limited downside in a mild US recession scenario, but plenty of upside in a deeper recession, the analysts said.

2. Banking Crisis

Speaking of the banking industry, it seems that the worst is yet to come.

The US banking sector fell into a deeper crisis this week when the government seized the assets of First Republic Bank and auctioned them to JPMorgan. This was the second-largest bank failure in US history and the third failure of a midsize lender in two months.

While many thought the sale of First Republic “would stop the ‘who’s next?’ conversations, investors are clearly continuing to focus on remaining players that are deemed the weakest” analysts at UBS wrote in a note to clients.

A selloff in bank stocks followed on Wall Street, a sign that uncertainty continues to plague the industry despite assurances from financial regulators and bankers. Market attention is now placed on PacWest and Western Alliance, whose shares have been under pressure since Silicon Valley Bank failed in mid-March.

The bigger worry, though, is that the bank failures might lead to doubts about relatively healthy banks, creating a financial contagion that could impact the wider economy.

This bodes extremely well for the prospects of gold, which responded positively to the market panic caused by accentuated fears amongst investors. Gold futures matched its all-time high of $2,072 per ounce on Thursday, while spot gold came within cents of setting a new record.

3. Fed’s Next Move

Also to monitor is the US Federal Reserve’s ultimate decision on interest rates. In a widely anticipated move this week, the Fed announced its 10th interest rate increase in just a little over a year, while also tentatively hinting that the current tightening cycle is ending.

We’ve previously established that real interest rates, rather than inflation, are what truly determines gold’s performance in longer periods. Should the Fed decide to pause the rate hikes, that would further strengthen bullion as it generally displays a negative relationship with real rates.

What’s more promising is that even when Fed Chair Jerome Powell was non-committal about pausing interest rate hikes, gold remained near the $2,000-an-ounce level, defying the patterns from previous rate increases. According to Powell, the central bank still needs to assess the fallout from recent bank failures, wait on the resolution of US debt negotiations, and monitor the course of inflation.

That being said, the market still expects May to be the last rate hike in this tightening cycle and sees a potential rate cut as early as September.

Analysts have told Kitco News that this environment of significant economic uncertainty “will remain fairly positive for gold even if market volatility does pick up on fluid Fed rate hike expectations.” Some noted that with so much uncertainty, the gold market should be able to hold support between $2,000 and $1,980 an ounce, even with a hawkish Fed.

“Gold’s ability to finish unchanged despite hawkish hints from (Fed Chair Jerome) Powell, positions it well for a fresh push toward all-time highs now that the Fed is on pause and the debt ceiling situation looks increasingly dire,” a New York-based analyst told Reuters.

4. Robust Gold Demand

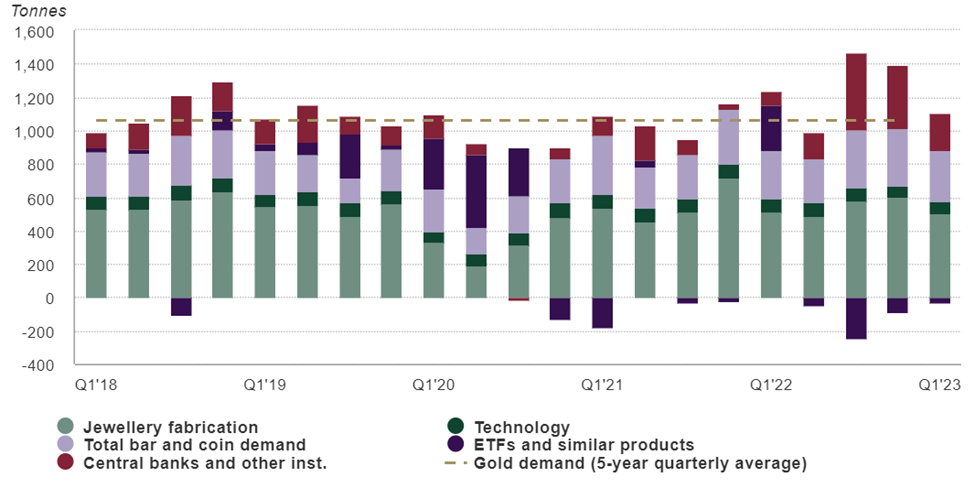

An indication of the precious metal’s strong appeal is robust demand from central banks, which bought a record high 1,087 tonnes of gold last year.

The buying spree continued into 2023. During the first three months, central banks added a total of 228 tonnes to global reserves, which is the highest rate of purchases seen in a first quarter, the World Gold Council said on Friday.

In an interview with CNBC, WGC senior markets analyst Louise Street emphasized gold’s growing importance to central banks during uncertain times, stating that:

“Top of the tree for gold in terms of why official sector institutions hold it is always things like its role as a diversification asset, its long term store of value, but increasingly over the last two years, we’ve seen the importance that they placed on its performance during times of crisis.”

On the investment front, Street also told CNBC that the Council saw a noticeable spike in demand in March, marked by a significant inflow into gold-backed ETFs after the collapse of Silicon Valley Bank, which partially offset the outflows in the first two months.

Bar and coin demand also rose 5% year-on-year, with US demand hitting its highest quarterly level since 2010 on the back of recession fears and a flight to safety amid the banking turmoil. This helped to offset weakness in Europe, particularly Germany, where there was a 73% drop in demand primarily due to real interest rates there turning positive and a rise in the euro gold price, which encouraged profit-taking.

According to the WGC, the mixed picture for Q1 highlights how gold’s diverse sources of demand underpin its role and performance as a global asset.

“Growth in some regions offset weakness in others as different economic forces and demand drivers played out in the global gold market. One commonality was that different types of investors looked to gold as a store of value in uncertain times,” Street wrote in the Q1 2023 report.

“Against the backdrop of turmoil in the banking sector, ongoing geopolitical tensions and a challenging economic environment, gold’s role as a safe haven asset has come to the fore. In this landscape, it is likely that investment demand will grow this year, especially with waning headwinds from the strong US dollar and interest rate hikes,” he added.

Giving a preview of what’s ahead, Street noted that: “Positive demand for gold ETFs has continued in Q2 so far, and the looming threat of developed market recession may be the trigger for inflows to accelerate later in the year. Central bank buying is likely to remain strong and will be a cornerstone of demand throughout 2023.”

5. Supply Stagnant

On the other side of the coin is supply, which the WGC estimates grew by 1% year-on-year to 1,174 tonnes in Q1 2023, driven by a marginal 2% growth in mine production and a 5% uptick in recycling.

However, with demand likely trending up through the rest of the year, it remains to be seen whether the supply growth would be sufficient to avoid a market deficit.

It’s important to note that last year’s gold demand surged by 18% to 4,741 tonnes, almost on par with 2011 – a time of exceptional investment demand, according to WGC data. Meanwhile, total supply only increased 2% to 4,755 tonnes, mainly due to mine production rising to a four-year high.

For silver, the market has already sunk into a prolonged supply shortage that could take years to recover from. Latest data from the Silver Institute reveals that annual silver demand also surged by 18% to a record high 1.24 billion ounces against a stagnant supply in 2022. This resulted in a second straight year of undersupply at 237.7 million ounces, which the Institute says is “possibly the most significant deficit on record.”

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

In 2023, we are most likely going to see a repeat of last year, according to the Institute, which expects the market deficit to remain high at 142.1 million ounces on the back of solid demand.

As concerns of undersupply linger on, the precious metals market will be well-positioned to maintain its bullish trend from the start of 2023.